As the final quarter of the year approaches the Budget Office in the Finance Ministry is preparing the framework document which the final budget will be based on. There is no doubt that the budget will again have a deficit as the government continues to struggle to reduce expenditure at the same time that oil prices remain lower than in previous years. Austerity measures and cost-cutting for some government expenses have helped but they are not enough to reduce the large deficit. The continuing war with daesh requires significant spending on defence and security, at the same time that oil wells, borders, and territory are still outside government control.

So faced with a deficit the budget planners need to do two things: find a way to reduce expenditure, and a way to increase revenues. Given that 97% of government revenues are based on oil sales and that taxes, and income from other sectors is unlikely to develop in the coming months, it is realistic to assume that the income side of the budget is almost identical to the revenues generated from oil exports. The oil export agreement with the KRG has effectively been abandoned since June and it is unwise of the Federal government to build in any expected revenues from northern oil sales for 2016. This leaves a simple projection of oil exports from the south and the expected average price of oil for 2016.

At the moment the southern terminals are exporting just over 3 million barrels per day. With investment in oil fields reduced by the IOCs and the government having to pay these companies in oil rather in cash, it would be reasonable to expect an average of 3m bpd for exports in 2016. This figure was also mentioned in recent comments by Oil Minister Abdul Mehdi on social media. Because southern Iraq is safe and no disruptions to oil exports are expected, we can assume that the 3m bpd level will be met.

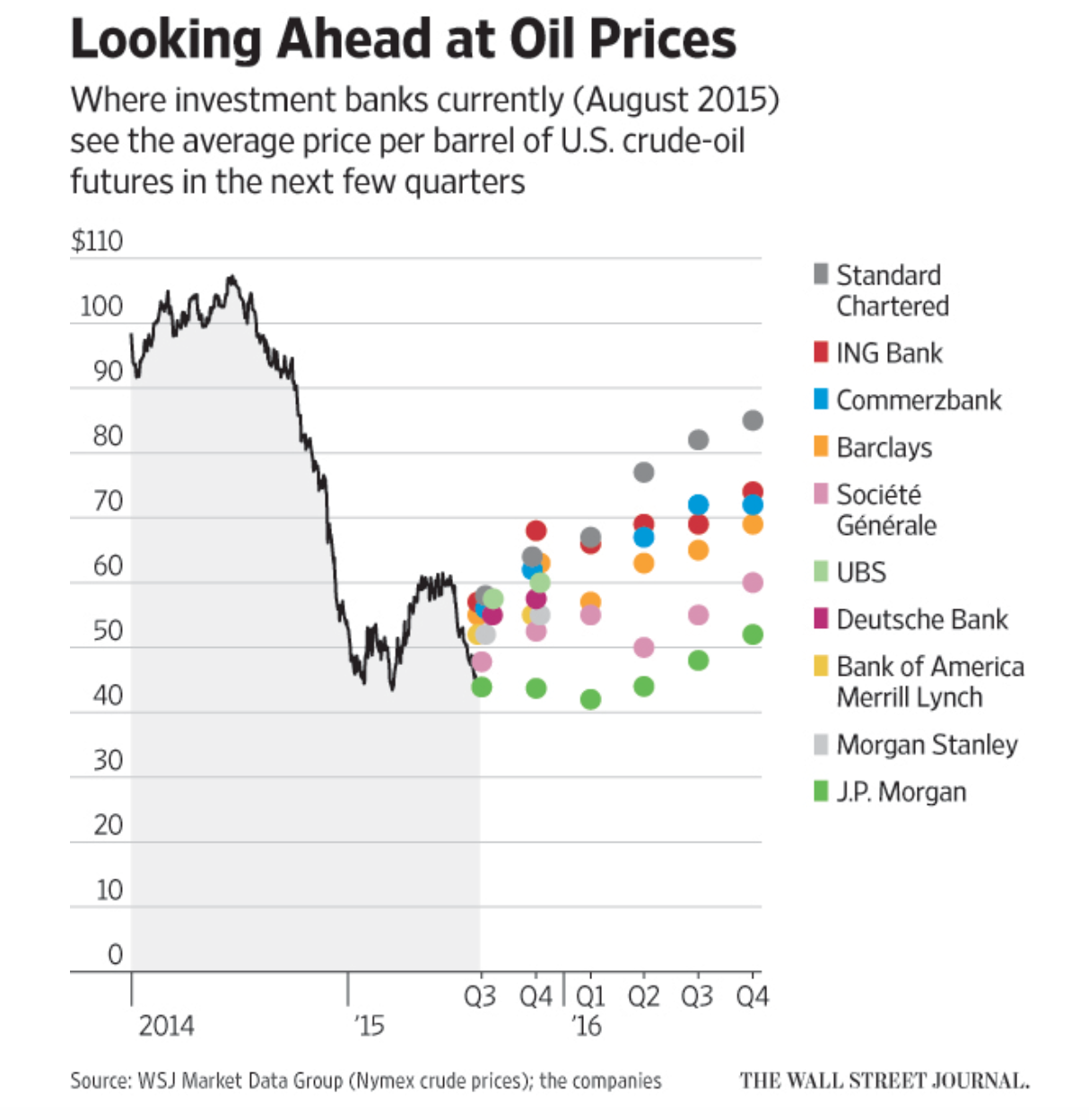

As for the selling price, it is highly unlikely that oil prices will reach $70 before the end of 2016. Reasons for this are excess supply in the market, depressed demand due to the global economic slowdown, increased production by OPEC and non-OPEC members, and the cheaper cost of producing shale oil in the US. Given that most analysts expect Brent crude to hover around the $50 mark in the beginning of 2016 and see no reason for prices to rise suddenly, it would be unwise to expect prices to be higher than $60 as a yearly average for 2016. Because Iraq receives between $4 and $12 less than the Brent crude price after export costs and price discounts, expecting a selling price between $45 and $50 seems sensible. Again, comments by the Oil Minister have mentioned similar figures. There are some predictions that the oil price may fall under $40 but this would not be for a prolonged time. Budgeting for $45 would be realistic and cautious, thus avoiding any unexpected deficits.

At $45 total projected revenues come in at $49.275bn and at $50 they are $54.75bn. A possible best case scenario of generating 10% of total government revenue from non-oil sources, and oil at $50 gives a figure of $60.83bn. An unrealistic projection of 3.6m bpd including northern fields, gives $73bn on 90% oil-based revenues. Considering all these projections leads us to plan for revenues between $50bn and $60bn. In Iraqi dinars this works out at 58tn IQD to 69.6tn IQD, assuming an exchange rate of $1 = 1,160 IQD.

In the 2015 budget there were unrealistic revenue forecasts of 94.05tn IQD versus expenditure of 119.59tn IQD, a deficit of 25.54tn IQD. Consequently, the budget deficit has increased significantly as oil prices have come in under the $56 projection and export numbers have not reached the predicted 3.3m bpd level. Non-oil revenues are only 3% versus the 17% expected. Therefore, Iraq is facing a scenario where revenues will fall again and it would be prudent to plan for total government revenues as coming in under 70tn IQD.

On the expenditure side it is unlikely that the government would be able to make any significant cuts due to the pressures of the war and the need to improve public services on the back of nationwide protests. Any savings in government expenses that PM Abadi’s reforms will bring in will be diverted to other expenditure rather than to reduce overall expenditure. It may be possible to freeze 2016 expenditure level at the 2015 level, so that it does not increase beyond 120tn IQD. This will require a freezing of all current ministerial and departmental spending, and almost no new investment in public services.

So planning for revenues of 70tn IQD at most, and expenditure of 120tn IQD at least, leaves a minimum deficit of 50tn IQD. Accepting that a large deficit is certain will help to plan for how to overcome it. The government may choose to pursue a mix of borrowing, whether through bond sales or foreign loans, sales of gold reserves, increase of the money supply, and the use of the foreign cash reserves. Each of these will likely increase the rate of inflation, so the government will need to counteract this.

There are several possible steps the government could take to prevent the economy from falling into a deep recession:

- Increase foreign investment

- New round of oil field licensing

- Privatization of government owned companies and utilities

- Increase income and corporate tax rates, improve collection

- Introduce sales taxes

- Increase customs and import tariffs

- Sales of public land and property

- New mobile phone operator licenses and other sector licenses

- Removal of energy subsidies

- Major support to the development of the private sector

Each of these steps requires legislative action and the government may find that the time taken for results to be seen will not alleviate the budget strains for 2016. But avoiding longer term economic trouble is probably more important than the short-term cash issue, so preparing a strategy for economic growth alongside one to plug the budget deficit is essential.